Meet Zurich Infinite Care. Apart from covering your medical bills including cashless hospitalisation assistance and out-patient benefits, this unit deducting rider rewards you for staying healthy with No Claim Discount. And best of all, this companion is one that understands your financial means and provides for different stages of life.

Comprehensive Medical Coverage with No Claim Discounts

Stay Healthy, Get Discount

Enjoy No Claim Discount of up to 30% on the insurance charges of this medical rider.

Stay Healthy, Get Discount

Enjoy No Claim Discount of up to 30% on the insurance charges of this medical rider.

Save More with Multiple Deductible Options

The higher your Deductible amount, the lower your insurance charges. You can even enjoy savings up to 77% on the insurance charges depending on the chosen Deductible amount.

Save More with Multiple Deductible Options

The higher your Deductible amount, the lower your insurance charges. You can even enjoy savings up to 77% on the insurance charges depending on the chosen Deductible amount.

Protect Against Inflation

Enjoy Inflation Shield benefit that enhances your coverage by rewarding you with a 20% increase on your Annual Limit every 5 years, based on the prevailing plan’s initial Annual Limit.

Protect Against Inflation

Enjoy Inflation Shield benefit that enhances your coverage by rewarding you with a 20% increase on your Annual Limit every 5 years, based on the prevailing plan’s initial Annual Limit.

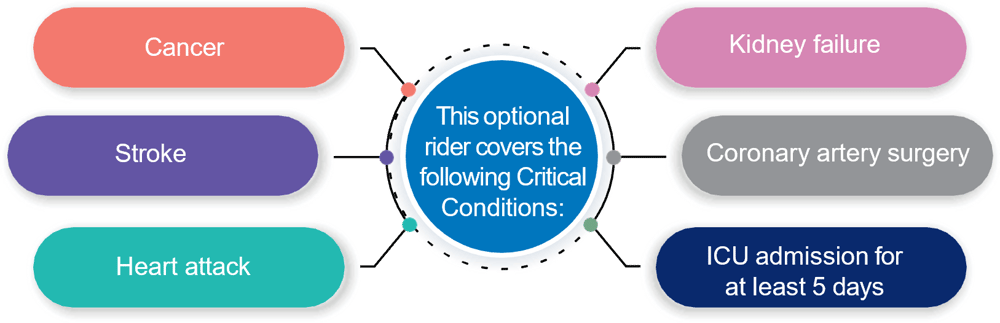

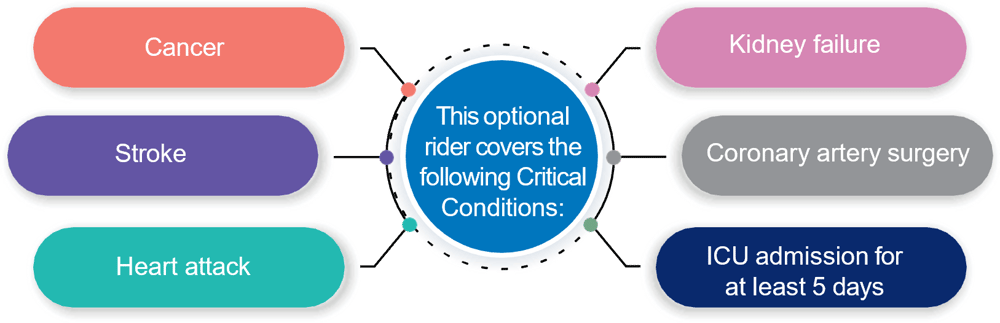

Get Additional Optional Coverage

You have the choice of enjoying further coverage for selected Critical Conditions with our Total Critical Care, which provides comprehensive medical treatment from pre to post hospitalisation.

The table below illustrates the benefits payable under this optional rider.

Benefits Payable RM a) Genomic Cancer Test

40,000

(limit per life) b) Survivor Benefit

(Reimburse up to 5 years per Critical Condition, maximum 2 different Critical Conditions per life)- Medical examination

- Imaging

- Specialist Consultation

- Medication

- Physiotherapy

- Traditional, Complementary, Speech, Occupational Therapies

8,000

(limit per year) c) Alternative Treatment Benefit

(Applicable within 90 days prior to Hospitalisation, Hospitalisation and within 210 days after discharge due to surgery)- Traditional and Complementary Therapies

4,000

(limit per disability)

Get Additional Optional Coverage

You have the choice of enjoying further coverage for selected Critical Conditions with our Total Critical Care, which provides comprehensive medical treatment from pre to post hospitalisation.

The table below illustrates the benefits payable under this optional rider.

| Benefits Payable | RM | ||

a) Genomic Cancer Test | 40,000 (limit per life) | ||

| b) Survivor Benefit (Reimburse up to 5 years per Critical Condition, maximum 2 different Critical Conditions per life)

| 8,000 (limit per year) | ||

| c) Alternative Treatment Benefit (Applicable within 90 days prior to Hospitalisation, Hospitalisation and within 210 days after discharge due to surgery)

| 4,000 (limit per disability) | ||

Comprehensive Medical Coverage

Get up to RM1,000 for Daily Hospital Room & Board, depending on the plan you choose. Comes with high annual limit with no lifetime limit to give you a total peace of mind.

Comprehensive Medical Coverage

Get up to RM1,000 for Daily Hospital Room & Board, depending on the plan you choose. Comes with high annual limit with no lifetime limit to give you a total peace of mind.

Early Years Discount

Enjoy discount on insurance charges of 35% for the first rider year and 20% for the second rider year, simply because you deserve it.

Early Years Discount

Enjoy discount on insurance charges of 35% for the first rider year and 20% for the second rider year, simply because you deserve it.

Longer Post-Hospitalisation Care

Receive reimbursement for diagnostic tests, specialist consultation as well as medication and treatment within 210 days after discharging from the hospital.

Longer Post-Hospitalisation Care

Receive reimbursement for diagnostic tests, specialist consultation as well as medication and treatment within 210 days after discharging from the hospital.

Medical Assistance Device Benefit

Should you need medical assistance devices such as Pacemaker, Artificial Limb or defibrillator, get reimbursement of up to RM20,000 on such expenses.

Medical Assistance Device Benefit

Should you need medical assistance devices such as Pacemaker, Artificial Limb or defibrillator, get reimbursement of up to RM20,000 on such expenses.

Retirement Option to Reduce Your Deductible

You can choose to reduce your Deductible amount according to your financial status, without underwriting after retirement. Terms and conditions apply.

Retirement Option to Reduce Your Deductible

You can choose to reduce your Deductible amount according to your financial status, without underwriting after retirement. Terms and conditions apply.

Who is eligible for this plan?

If you are an existing policyholder with Flex Maternity Care rider, you can activate the Option to Purchase New Policy for Child and attach this rider to your child's policy immediately after birth.